Is this career for you?

Do the following statements accurately describe you?

- You are currently enrolled in a general arts, education, humanities or a business program at the post-secondary level

- Your current program of study requires the ability to communicate complex ideas, critical thinking, time-management and organization

- You have strong communication and interpersonal skills

- You are self-motivated, outgoing, open-minded, and enjoy learning new things

- You have excellent verbal and written communication skills

- You have strong analytical and judgment skills and pay attention to detail

- You have (or had) a part-time job that involves decision-making and problem-solving, interpersonal and communication skills, such as a nurses aide, restaurant server or retail sales associate

If you answered yes to these statements, then a career as a risk manager might be the perfect fit!

How do I get there?

A combination of the following qualifications would be helpful in gaining employment in the property and casualty insurance industry.

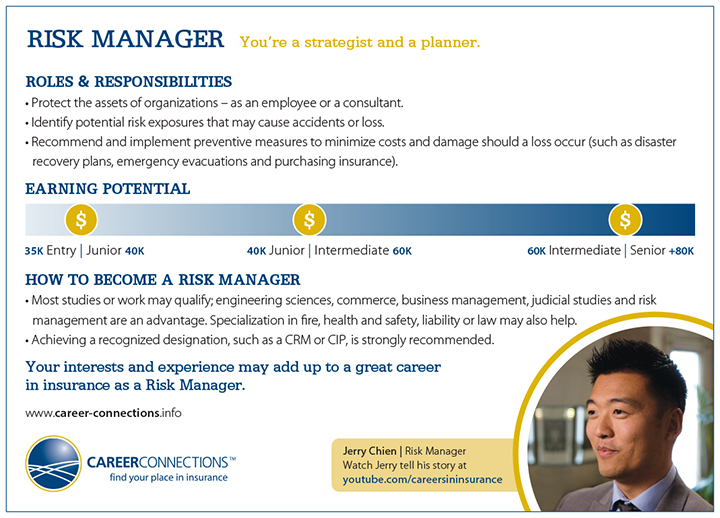

College/University

A college diploma or university degree in engineering science, commerce, business management and judicial studies are acceptable for entry into the profession, though those who have earned a degree or specialization in risk management are at a distinct advantage.

Licensing

There are no licensing requirements for this career at time of publication.

Professional Qualifications